Market Growth Projections

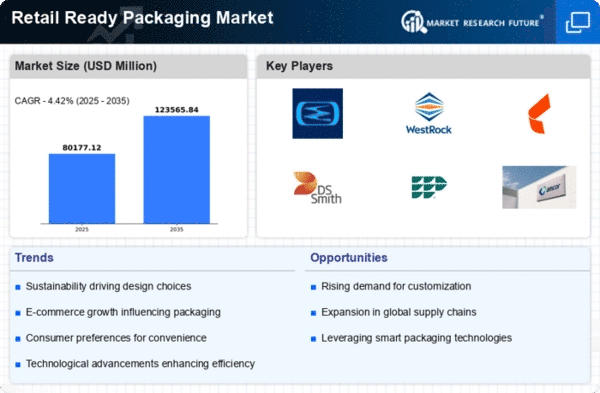

The Global Retail Ready Packaging Market Industry is projected to experience substantial growth in the coming years. With a market value of 76.8 USD Billion anticipated in 2024, the industry is expected to expand further, reaching 123.4 USD Billion by 2035. This growth is indicative of a compound annual growth rate (CAGR) of 4.41% from 2025 to 2035. Factors contributing to this growth include increasing demand for sustainable solutions, the rise of e-commerce, and advancements in packaging technology. As these trends continue to evolve, the market is poised for significant expansion.

Increased Focus on Supply Chain Efficiency

Supply chain efficiency is a critical driver in the Global Retail Ready Packaging Market Industry. Retailers are increasingly adopting packaging solutions that streamline logistics and reduce costs. Retail ready packaging is designed for easy handling and display, which can lead to faster replenishment on store shelves. This efficiency not only enhances operational performance but also improves inventory management. For instance, companies are implementing packaging that allows for better stacking and storage, thereby optimizing warehouse space. As a result, the market is anticipated to grow significantly, reaching 123.4 USD Billion by 2035, driven by these efficiency improvements.

Technological Advancements in Packaging Design

Technological advancements are reshaping the Global Retail Ready Packaging Market Industry. Innovations such as digital printing and smart packaging are enabling brands to create more engaging and informative packaging solutions. Digital printing allows for customization and quick turnaround times, while smart packaging incorporates features like QR codes and NFC technology to enhance consumer interaction. These advancements not only improve the aesthetic appeal of packaging but also provide valuable information to consumers. As technology continues to evolve, it is likely that the market will see an influx of creative packaging solutions that cater to diverse consumer preferences.

E-commerce Growth Driving Packaging Innovations

The rise of e-commerce has a profound impact on the Global Retail Ready Packaging Market Industry. With online shopping becoming increasingly prevalent, retailers require packaging that not only protects products during transit but also enhances the unboxing experience for consumers. This demand for innovative packaging solutions is driving investments in design and technology. For example, brands are exploring tamper-evident features and easy-to-open designs to improve customer satisfaction. As e-commerce continues to expand, the market is expected to grow at a CAGR of 4.41% from 2025 to 2035, indicating a robust future for retail ready packaging.

Growing Demand for Sustainable Packaging Solutions

The Global Retail Ready Packaging Market Industry is witnessing an increasing demand for sustainable packaging solutions. Consumers are becoming more environmentally conscious, prompting retailers to seek packaging that minimizes waste and utilizes recyclable materials. This shift is evident as companies adopt eco-friendly practices, which not only enhance brand image but also meet regulatory requirements. For instance, the use of biodegradable materials in retail ready packaging is on the rise, aligning with global sustainability goals. As a result, the market is projected to reach 76.8 USD Billion in 2024, reflecting a significant trend towards sustainability in packaging.

Consumer Preferences for Convenience and Portability

Consumer preferences are shifting towards convenience and portability, significantly influencing the Global Retail Ready Packaging Market Industry. As lifestyles become busier, consumers seek packaging that is easy to carry and use. Retail ready packaging that offers single-serve options or resealable features is gaining popularity among consumers. This trend is particularly evident in the food and beverage sector, where on-the-go packaging solutions are in high demand. Retailers are responding by designing packaging that meets these needs, thereby enhancing customer satisfaction and loyalty. The market's growth trajectory is likely to reflect these evolving consumer preferences.